You Probably Live Within 10 Miles of a Craft Brewery

At least two breweries open every day in the United States. Most are smaller-batch, independent breweries. So fast is the pace of growth, there are now around 6,000 craft brewers in the United States, and there’s a good chance that you live within ten miles of the one nearest you.

Vermonters are the luckiest: they have the most craft breweries with 11.5 breweries for every person living in Vermont. Pennsylvania takes the prize for highest production of craft beer. Its 282 craft breweries pump out pumped out 3,724,000 barrels in 2017, according to the Brewers Association. If you don’t have a local craft brewery, you’re won’t miss out. The surge in craft beer sales is largely thanks to the rising number of supermarkets and big chain convenience stores that started carrying a bigger selection of them.

I’ll Toast to That, Eh

Craft brewers pride themselves on innovation, coaxing a unique flavor profile from traditional or novel brewing ingredients and the fermenting process. But for almost all of them, the brewing process begins just the same — on an American farm with the barley used to make a brewer’s malt.

The popularity of American craft beers is one of the major reasons behind the increase in demand for craft beers in Asia and Europe. American craft beer exports have never been higher. According to the Brewers Association, American craft breweries sold 482,309 barrels valued at $125.4 million to customers overseas in 2017.

Over half of American craft beer exports (51.3 percent) went north to our good beer-drinking friends, the Canadians. The United Kingdom accounted for 10.5 percent of our craft beer exports, followed by Sweden (6.7%), Korea (4.6%), Australia (3.8%), and China (2.5%). Sales in the Asia-Pacific region (not including Japan) grew fastest 7.4 percent.

NAFTA Keeps Barley Sales to Mexico Hopping

According to the U.S. Grains Council, Mexico is the top importer of American barley, driven by demand from Mexican beer brewers. Mexico lacks sufficient malting capacity, but American barley and malt can be purchased by Mexican brewers duty free under NAFTA. The U.S. Grains Councils says that, over the last ten marketing years, more than 160 million bushels of barley valued at $1.82 billion was sold to Mexico. In the true spirit of North American co-production, much of the beer produced in Mexico is sold to American beer drinkers. The U.S. Department of Commerce estimates that seven out of every ten beers imported originate in Mexico.

So, there’s a lot a risk of NAFTA negotiations don’t go well. Herb Karst, a grain farmer from Billings, Montana, recently spoke at an event by Farmers for Free Trade. He said Corona beer, the fastest growing brand in the United States, is brewed in Mexico with U.S. barley, “some from my own farm. If NAFTA goes away, customers could see higher costs on imported beer, which could be made with Australian or European barley instead.”

CCM/Heineken of Mexico recently announced it would look elsewhere for malted barley if the United States leaves NAFTA. CCM/Heineken sourced 4.6 million bushels of barley — 100 percent of its barley needs — from Montana in 2017.

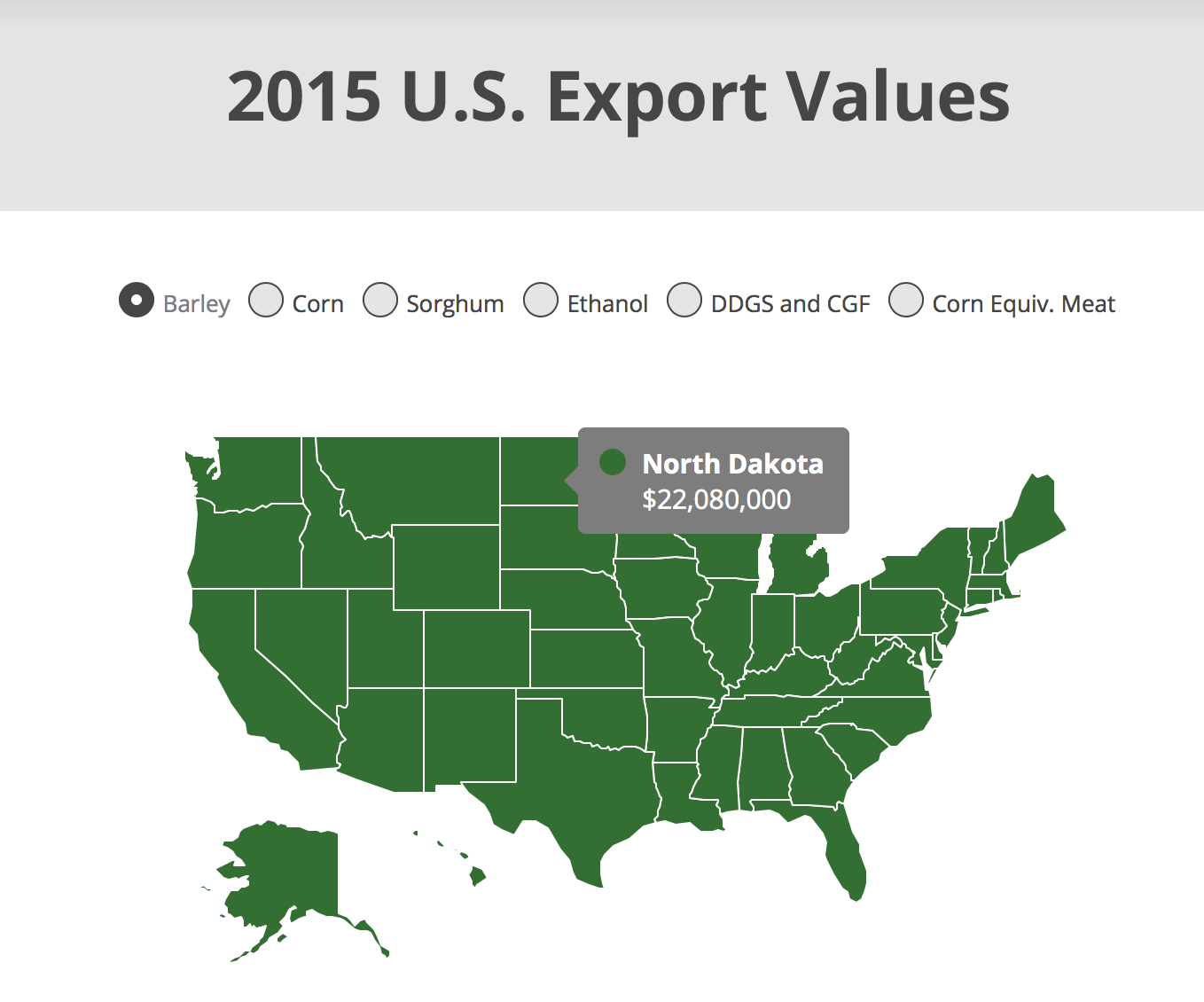

The U.S. Grains Council has an interactive map at grains.org so you can see how much each U.S. state exports of various grains. Montana is a major barley producer, but so is Nebraska.

What’s on Tap with More Tariffs

The American craft brewing industry is also worried about the possibility of a 25 percent tariff on products from China and new tariffs on imported steel and aluminum.

In the brewing process, malt is added to heated water and broken down into mash, which is then transferred to a straining vessel. Next, the brew is boiled and flavored with hops, and then allowed to ferment. After fermentation, the yeast is removed, leaving behind beer. Of course, the beer has to be packaged into cans or bottles before it can be shipped to its next destination.

The Trump administration’s proposed list of tariffs on products from China included brewing equipment. And the Brewers Association is also worried about whether separate tariffs the Administration has imposed under Section 232 on aluminum products include stainless steel tanks and kegs. If it does, the cost of capital investments for small, independent brewers will go up, and the association even cited concerns that higher stainless steel prices will cause an increase in keg theft, something that is apparently a big problem in the brewing industry.

As for the cans, although most craft beer is still packaged in bottles, the association is seeing a shift toward use of cans, particularly by the smallest breweries (90 percent of the industry) that produce 10,000 barrels a year or less. According to the Brewers Association, cans are the top packaging method for new breweries.

The American craft brewing industry is hoping they will not get caught in this part of a trade war. After all, brewing materials may not be essential to national security, but there’s a good case to be made they are essential to national happiness.