Peeling Away Trade Protections for Bananas

Simple in appearance, pleasantly sweet, nutritious, and nearly universal in appeal, that Cavendish bunch of bananas on your counter comes off as pretty unassuming. In reality, it has been through jungle wars and trade wars and now sits on the precipice of extinction. More than half of the bananas traded globally are the Cavendish variety. But with two diseases threatening the world’s largest Cavendish plantations, growing to love more varieties could help save trade in bananas.

Still an Important Cash Crop

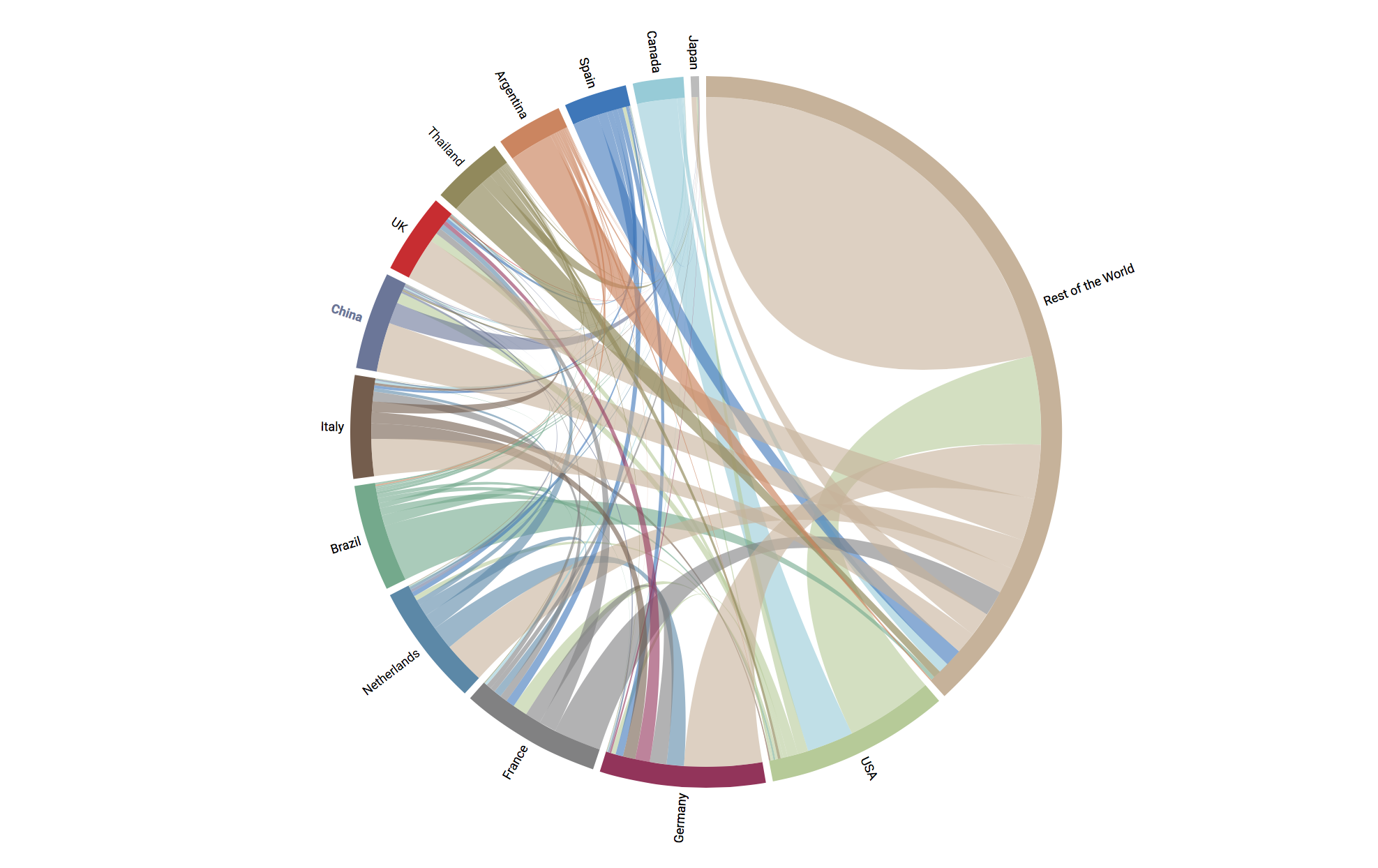

Grown in more than 150 countries, bananas are the eighth most important food crop in the world – fourth most important in developing countries. Bananas are among the most traded fruit in the world, generating revenues of more than $8 billion a year for the top banana exporters including Ecuador, the Philippines, Costa Rica, Colombia and Guatemala. However, most are produced for local or national consumption.

For example, the Food and Agriculture Organization estimates that between 70 and 80 percent of bananas in Africa are produced by smallholder farmers. Around 114 million tons are produced globally beyond what isn’t too small to be counted, yet only 19 million tons were shipped globally. That said, for the top five exporters, bananas are a major contributor to the total value of their agricultural exports. India and China are among the biggest producers but their output mainly serves the large domestic markets.

Peeling Away Trade Protections

The Banana Wars, centered on the European Union’s (EU) banana trade regime, spanned 20 years as the longest running series of disputes in the multilateral trading system to date (although the Boeing-Airbus dispute may be on track to take that title). As one of the most significant episodes in trade law, the Banana Wars are deserving of more attention, but here are some abridged highlights.

Europe’s banana regime began as an umbrella for complex arrangements at the individual EU Member State level that were designed to offer exclusive or preferential access to former colonies in Africa, Caribbean and the Pacific (ACP), and at the same time shield EU producers from competition.

Under the EU’s original regime, ACP countries received a zero-tariff rate while imports from other countries were taxed at 20 percent. However, each Member State was allowed to “derogate” and maintain special protective provisions for imports from their overseas departments. For example, France set aside two-thirds of its market for Guadeloupe and Martinique and the remaining third for the ACP Franc Zone states of Cameroon and Cote d’Ivoire. The Spanish market was reserved for shipments from the Canary Islands. Greece banned imports to protect its own production in Crete. Only Germany opened to free trade.

The Single European Act of 1986 mandated an integrated EU market by January 1993, which required that Member States consolidate their programs into a common regime for bananas. As devised, this version still enabled members to discriminate among imports by source, offering better terms to their overseas departments and to imports from ACP countries. Colombia, Costa Rica, Guatemala, Nicaragua and Venezuela (supported by the United States) challenged the regime as inconsistent with the EU’s obligations under the GATT.

The EU’s ability to offer tariff preferences was upheld because it had a waiver in the GATT for its general tariff preference program; but the GATT Panel found the EU’s discrimination through tariff quotas to be inconsistent with its obligations. However, prior to the WTO, a GATT member could simply veto the outcome of a panel decision, enabling the EU effectively to ignore the GATT Panel ruling.

Second Banana

The EU revised its banana regime in 1993 to include new special distribution licenses under a general quota. Licenses were divvied up among primary importers and importers performing secondary activities such as customs clearance, warehousing and storage; licenses were dependent on historical performance, subject to country allocations, market share and other criteria. After yet another challenge by the five Latin American countries, a GATT Panel found in 1994 that the EU’s licensing system was excessively restrictive and not covered by its waiver.

After 1995, with the WTO’s enforceable dispute settlement system in place and additional obligations to avoid discrimination in trade in services, the EU recognized it would face more challenges to its regime. The large multinational producers involved in shipping, warehousing, ripening, marketing and distribution had an even stronger case to make. The EU negotiated with all of the disgruntled Latin American producers but Guatemala to head off the legal challenge. Having offered additional or expanded quotas, they temporarily pleased some countries but further worsened the discriminatory effect for those countries not a part of the negotiation.

A third complaint against the EU’s banana regime was reviewed in the WTO in 1996, this time with the United States as the lead plaintiff in response to complaints from Chiquita and the Hawaiian Banana Association. A WTO decision in 1997 again concluded that, although the EU’s discriminatory tariffs were covered under its historical waiver, its tariff quota allocations and convoluted import licensing administration violated its WTO obligations. The EU’s next version of its banana regime did little to remedy the discriminatory elements, which led to the imposition of tariffs by the United States and Ecuador in response to the EU’s failure to comply with the WTO ruling. By 2001, the EU made another attempt to transition its system, but not until 2006 would the EU decide to phase in a tariff-only system, dispensing with quotas.

Banana Splits

At the end of 2009, after negotiations with non-ACP producers, the EU agreed to reduce the tariff rate it applies to all WTO members. Tariffs would come down from 176 euros per ton to 114 euros per ton by January 2017 (stipulating it could revert to higher rates if exporting countries exceed a “trigger” amount of imports). It wouldn’t be until 2012, that the EU and 10 Latin American countries finalized signed an agreement in the WTO to codify the revised EU banana tariff schedule (“The Geneva Banana Agreement”), officially closing the longstanding legal disputes.

As a prologue, the EU signed trade agreements with Andean and Central American countries in 2013 and Ecuador in 2017. Ecuador has seen a large bump in global export volume as its agreement with the EU is implemented. By next year, the tariff on bananas from Ecuador to the EU will go down to 75 euros per ton with no quota on the amount eligible for this rate. As the EU continues to edge toward “freer” trade in bananas, the ACP producers will face considerable adjustment.

Going Bananas

Having survived the banana trade wars, the popular Cavendish banana faces a new challenge, one that could actually wipe them out.

“Panama disease TR4” has ravaged thousands of acres of Cavendish plantations throughout Southeast Asia and Australia and is spreading to Africa and the Middle East. It can lie dormant in soil for decades and has proven resistant to fungicides and fumigants. It is only a matter of time before TR4 takes hold in Latin America, which supplies nearly the entire U.S. market. Banana plantations in the Caribbean are threatened by another disease called Black Sigatoka, which has been reducing banana yields by 40 percent every year in affected areas.

Before Cavendish was top banana, a banana called the Gros Michel (Big Mike) dominated the banana trade in the early 1900s until the fungus TR1 took it to the brink of extinction in the mid-1950s. At that time, the Cavendish variety from China was discovered to be resistant to TR1 so it replaced Mike. But bananas don’t have seeds. They breed asexually so they cannot recombine their genes to ward off threats. In other words, the Cavendish is ripe for attack because it cannot evolve – every generation is a clone of the previous.

Try Hanging with a New Bunch

If scientists don’t make a breakthrough, TR4 and TR1 could spell the end for the beloved Cavendish. With over 1,000 different varieties of bananas growing around the world, why not get to know some others that might grow more popular through trade – here are a few to get you started.

For your next dessert, try using Niño, Manzano (“apple bananas”) that have a hint of apple and strawberry flavor, or Goldfinger, a newer variety from Honduras. Intriguingly, there’s also Blue Java, named for its blue skin, which has a creamy, ice cream-like texture and purportedly offers a subtle vanilla flavor.

Cooking bananas include the Macho plantain and other fun-sounding varieties like the Burro which has squared sides and a lemon flavor when ripe, and the Rhino Horn from Africa, which can grow up to two feet long. If consumers demand it, perhaps global trade in bananas will finally branch out.

Andrea Durkin is the Editor-in-Chief of TradeVistas and Founder of Sparkplug, LLC. Ms. Durkin previously served as a U.S. Government trade negotiator and has proudly taught international trade policy and negotiations for the last fifteen years as an Adjunct Professor at Georgetown University’s Master of Science in Foreign Service program.