How Does China Cheat? The White House Counts the Ways

Near Term Tariff Shock

Newspapers all over the country are running stories about the staggeringly large and unprecedented tariffs the Trump Administration is imposing on imports from China. The tariffs will touch about every category of product we buy, from the food in our refrigerators to the refrigerators themselves; from the hats on our heads and shoes on our feet to the fabrics, yarns, and rubber that went into making them. Our ATMs come from China, along with vacuum cleaners, shampoo, purses, and bicycles.

Along with these consumer goods, the tariffs will increase the cost of doing business for many American manufacturers across all industries. The tariffs reach inputs from minerals and metals, to building materials, turbines, engines, auto and tractor parts, and many of the machine tools companies use to fashion products. As for U.S. companies operating in China, a survey by AmCham China finds that over half are growing concerned about the impact of tariffs on profits and just under half reported higher production costs and decreased demand for their products. Only 11.8 percent said they’ve already undertaken layoffs.

White House economists have suggested a muted impact because most products targeted could be bought elsewhere but made no mention of whether they are directly substitutable or competitively priced. Producers in Europe, elsewhere in Asia, and Latin America will still be buying inputs from China at cheaper prices because they aren’t paying the tariffs, which may help them compete against U.S. products globally – and in our own market. So, there’s a free rider problem here too, of our own making.

So, Why is the Administration Using Tariffs?

Despite the adverse impact to our economy and the pain of tariff adjustment (let’s for a moment set aside the ramifications for the global trading system), tariffs are about the only tool the Administration has for putting the brakes on China’s serial theft of U.S. technologies and intellectual property.

Having dispensed with the caveats about the negative impact of tariffs, it would be possible to contrast the use of tariffs to wage a trade war versus the tactics that have been deployed by the Chinese government for more than decade.

It comes down to this: if you want to understand what barriers Chinese products will face in the U.S. market, you can look at the U.S. tariff schedule. Find a product line, move your finger over to the right of the page, and see what percent simple tariff will be applied to that product if imported from China. The President is proposing to increase the rates on 5,745 full or partial lines in the tariff code by 10 percent effective September 24. The rates will go up to additional 25 percent effective January 1, 2019.

So, there you have it. The effects will be complicated, but the tariff barrier is not. The measure was announced and applied after receiving public input in the form of written submissions and public hearings (most opposed the measure). And, we hope it’s temporary. As a government action, the tariffs can be lowered or removed in the tariff schedule fairly easily, even if the impact in practice is longer lasting.

A Tariff Versus an Entire Economic System

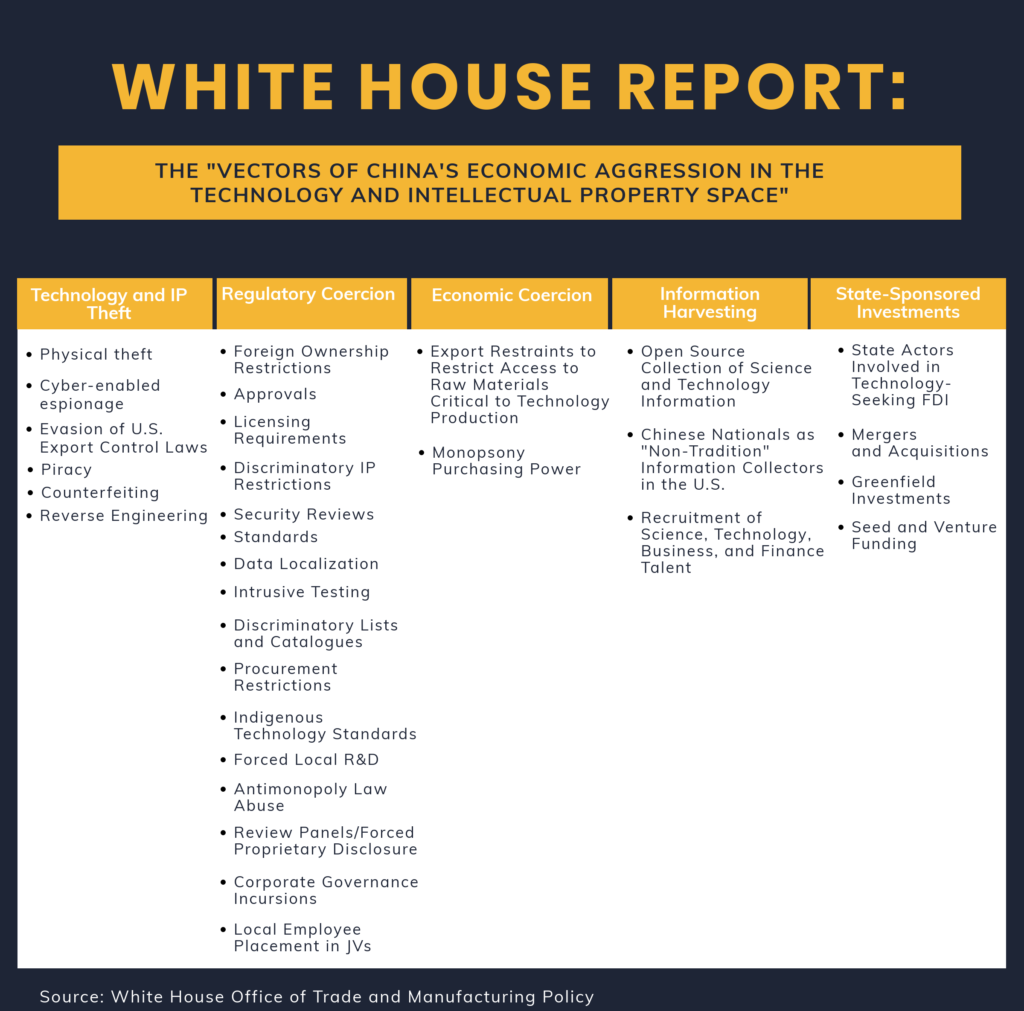

Contrast this with approach with the 30 different ways the White House has identified that the Chinese government has embedded restrictions on foreign access to their market into its economic system. In its June 2018 report, the White House creates a taxonomy of ways the Chinese government acquires American technologies and intellectual property to aggrandize Chinese productive capabilities, stand on the shoulders of American innovation, siphon information from open and proprietary sources, and enlist Chinese nationals to accrue knowledge through research arms of universities and companies in the United States.

Specific methods include physical and cyber-based theft of commercial intellectual property; regulatory requirements that extract sensitive, competitive information for companies or impose mandates to transfer technologies; forcing foreign companies to establish research and development in China; and requiring foreign patent or technology holders to accept below-market royalty rates and accept unreasonably short intellectual property protection terms. The report paints a picture of American companies routinely ensnared in a web of regulatory requirements that expose their competitive assets in exchange for the opportunity to participate in China’s market.

“The Chinese government has shown itself to be quite adept at abandoning certain tactics when they become discredited due to global pressure, only to adopt new and more effective ones in service of its overall mercantilist strategy.”

If you’ve worked for a multinational corporation like I have, you know that China is not a market they can sit out. And if you work in government relations, you bear the scars of trying to counteract or navigate a variety of these mandates and regulatory complexities. It has become unfortunately routine to find your company on the wrong side of a government anti-competition inquiry. Companies don’t share their war stories though. If you’re Adidas and the Chinese government is focused on the price of Nike shoes, you duck and cover. It’s this dynamic, along with the fear of retribution from the Chinese government, that enable the stories to go unreported and has made it hard for the U.S. Government to do much about it for years.

The Administration is not merely concerned with the treatment of our companies’ technologies and ideas in China. They’ve outlined concerns with China’s “Out Going” strategy that has tentacles throughout the United States and elsewhere. Chinese State actors are deployed in large-scale collection of open-source science and technological discoveries in American institutions; State-run entities have built research and innovation centers in places like Silicon Valley alongside American tech companies; and State-sponsored overseas investments are increasingly designed to acquire key U.S. technologies. According to CB Insights, China-based investors have put some $20 billion into more than 600 high-tech investments in the United States in projects around artificial intelligence, deep learning, augmented and virtual reality, and robotics.

If it sounds sinister or paranoid, the Chinese government writes these things down. The strategy is boldly designed, disseminated, and executed by party officials at all levels. It’s articulated in China’s National Program for Science and Technology Development, in the Made in China 2025 Strategy, in Five-Year plans and administrative guidance. The Administration is relying on reports from the U.S.-China Economic and Security Review Commission, the U.S. Department of Defense, and the Office of the National Counterintelligence Executive when they make these assertions.

What Can Be Done About China?

Having surfaced the systemic bias against foreign firms and the brazen mandates designed to acquire key foreign technologies and innovations, the question remains what to do about them. Tariffs are merely an attention-getter and more commitments from China are likely to prove inadequate. The Administration has put together a chart of promises made but not kept over the years.

If the Chinese government does provide redress on some measures, it will seek out different means to accomplish its national economic goals but is not likely the change the course of its strategy. Rob Atkinson of the Information Technology Industry Foundation (ITIF) says, “This fight cannot be about individual tactics, for the Chinese government has shown itself to be quite adept at abandoning certain tactics when they become discredited due to global pressure, only to adopt new and more effective ones in service of its overall mercantilist strategy.”

And so, the Administration is waging a long campaign. If it does know what outcomes it will find acceptable to remove the tariffs, it’s keeping its cards close to the vest. Perhaps the Administration is already working with other governments to develop proposals for new global rules to place limits on some of China’s 30 approaches or bring them into line with international norms.

Stay Focused on the Goal

I’m no fan of tariffs – they cut against the American grain. Our entrepreneurial culture and success are built on a philosophy of less government interference in the marketplace. They will have an impact on our strong economic growth, and if imports go down, so will our exports.

But as we begin to tell the thousands of individual stories about the self-inflicted tariff wounds, we must also keep another number in the forefront: 30. Because it’s those 30 ways China is turning the economic screws that created the conditions for this tariff war.

Required Reading:

To understand the Administration’s stance on China’s trade, investment, and intellectual property strategies, read this report by the White House Office of Trade and Manufacturing Policy issued June 2018: How China’s Economic Aggression Threatens the Technologies and Intellectual Property of the United States and the World.

The White House “Economic Aggression” report is surprisingly easy to read and far shorter than the well-researched, heavily footnoted Section 301 investigation findings issued in March by the U.S. Trade Representative. But students of trade policy should read both.

Andrea Durkin is the Editor-in-Chief of TradeVistas and Founder of Sparkplug, LLC. Ms. Durkin previously served as a U.S. Government trade negotiator and has proudly taught international trade policy and negotiations for the last fifteen years as an Adjunct Professor at Georgetown University’s Master of Science in Foreign Service program.